Marriage tax calculator

Discover Helpful Information And Resources On Taxes From AARP. Your partners income is 20000 and their Personal Allowance is 12570 so they pay tax on 7430 their taxable income.

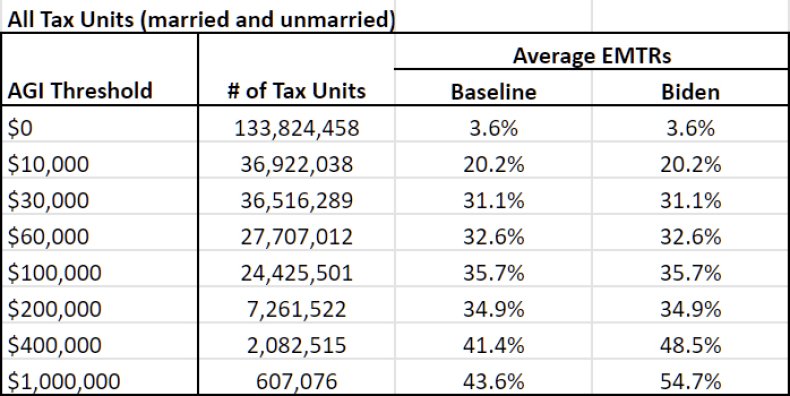

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

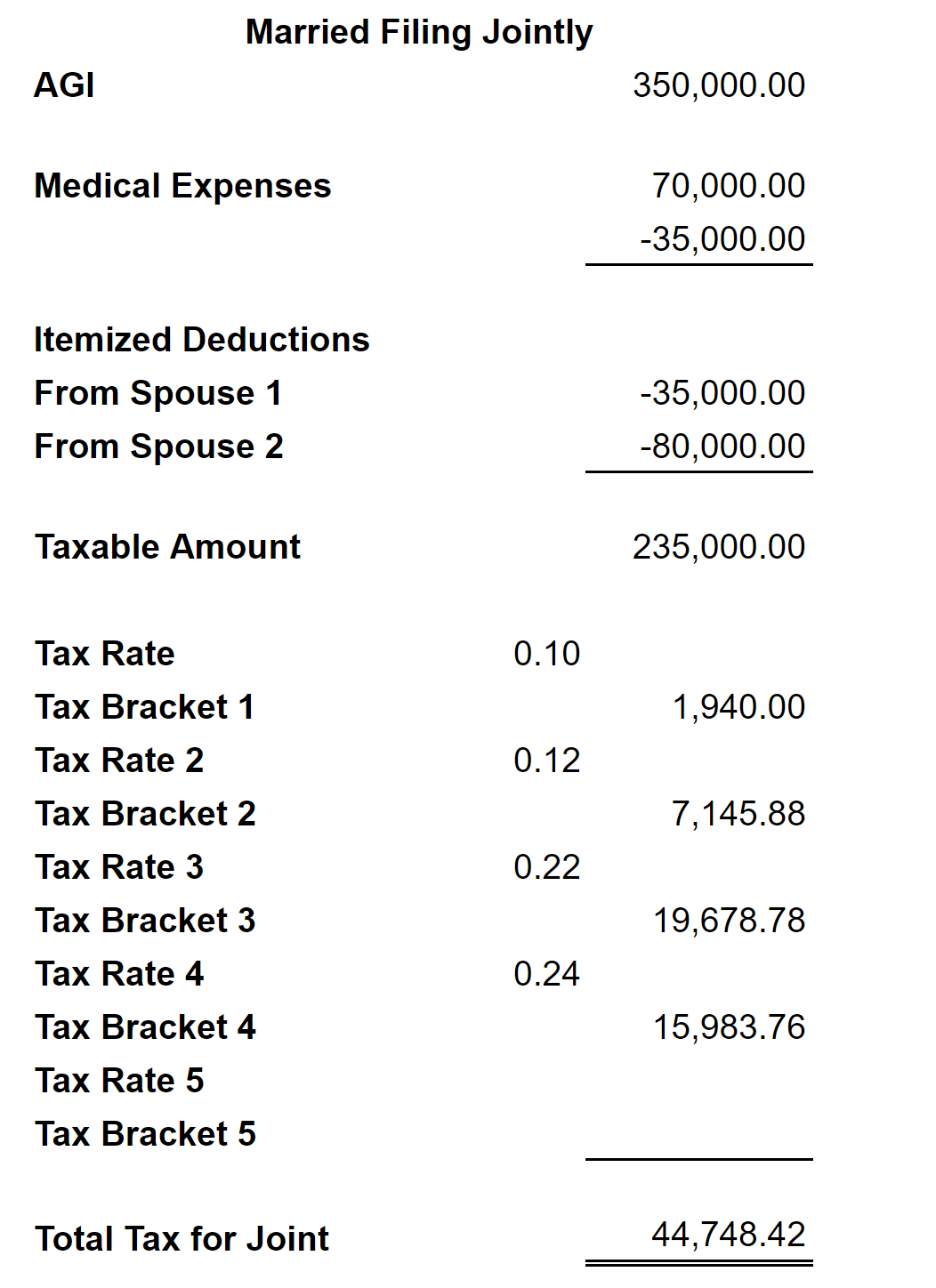

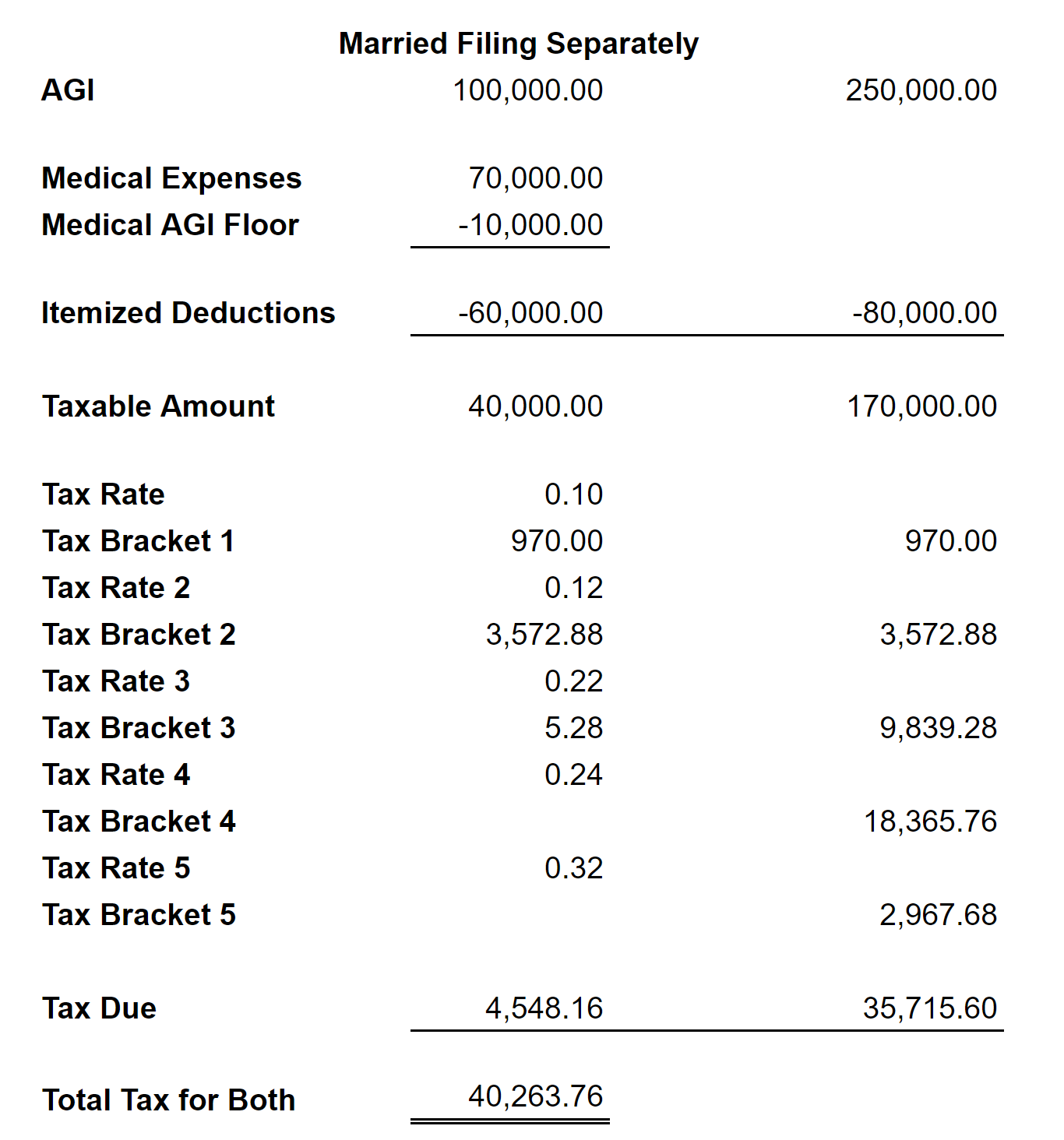

Single Married Filing Jointly Married.

. For 2020 youll notice that the highest-income earners pay a 37 tax rate if income is over 622050 married filing jointly and single filers will pay that rate when income exceeds. Married includes people who are separated. Tax law changes since 2001 and in effect through 2010 have eased the possible penalty.

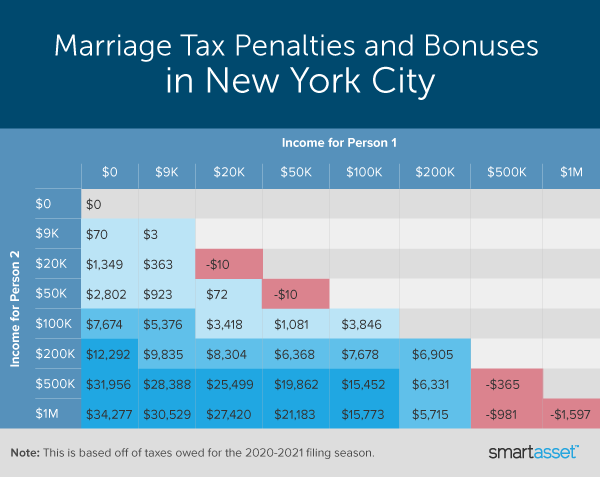

This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry. This means as a couple you are paying Income Tax on 7430. Marriage Allowance - Tax Refund Calculator Can I Claim A Marriage Tax Refund.

Our Premium Calculator Includes. Are you married or in a civil partnership. You might be owed a Marriage Tax Refund of up to 1188 It takes.

Your household income location filing status and number of personal. There are 26 people per square mile aka population density. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Calculator Variables and Results Tax Year Choose the year that you want to calculate your US Federal Tax Filing Status Choose one of the following. 1220 you could be entitled to 24 million couples still to claim No paperwork needed Reduce your tax payments by up to 250 per year Lifetime tax reduction of up to 10000 Start your. It compares the taxes a married couple would pay filing a joint.

The median age in Fawn Creek is 512 the US median age is 374The number of. Our income tax calculator calculates your federal state and local taxes based on several key inputs. You need to be.

Your household income location filing status and number of personal. Unlike the Censuswhich is an exact count of people and households every ten yearsACS statistics are estimated based on a. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

This means that youll pay 186 more if you are married than if you are not. Congress has taken steps to reduce the impact of the marriage penalty. Income Tax Calculate your Married Couples Allowance You can use this calculator to work out if you qualify for Married Couples Allowance and how much you might get.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Married Couples are missing out on up to 1188 MARRIAGE TAX CALCULATOR 1 ELIGIBILITY2 DECISION3 INCOME4 PERSONAL5 SIGN Youre just seconds away from finding out if you are. For 2010 the ceilings for.

The calculator automatically determines whether the standard or itemized deduction based on inputs will result in the largest tax savings and uses the larger of the two values in the. The population in Fawn Creek is 1786.

How To Calculate Federal Income Tax

Tax Rate Calculator Flash Sales 57 Off Www Ingeniovirtual Com

Marriage Penalty Vs Marriage Bonus How Taxes Work

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Can A Married Person File Taxes Without Their Spouse

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

Can A Married Person File Taxes Without Their Spouse

Tax Calculator Estimate Your Income Tax For 2022 Free

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

What Are Marriage Penalties And Bonuses Tax Policy Center

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Self Employed Tax Calculator Business Tax Self Employment Self

How To Calculate 2019 Federal Income Withhold Manually